Do you need to keep a mileage log?

Posted on 28th February 2019 at 16:22

What is a mileage log?

If you use a vehicle for the purpose of your business, a mileage deduction is a great way to save a little extra tax. However, HMRC won’t just take your word for it, in order to claim this deduction you need proof. In other words, you need a mileage log.

Why should I keep a log?

If you are self-employed, work as a sole trader or within a partnership, and you use a vehicle for business purposes then you should be eligible for a tax deduction.

This doesn’t extend to private use of the vehicle though, so if you use the vehicle for private purposes also, HMRC will disallow any motoring costs and capital allowances in proportion to the cost of the vehicle and estimated amount of private use in question.

How do I keep a log?

The only practical way to go about keeping a log is to record your car mileage at the beginning and end of your trading year, to ascertain the total miles for the period and a log of your business miles.

Keep in mind that at a minimum, you should be able to provide evidence of total annual mileage and a detailed record of business mileage for the same period. The log should include the following information:

Date of the journey

The purpose (business or personal)

Point of origin and your destination, and

The total miles travelled.

This could be recorded in a diary kept in your car, by using the free Moulds & Co App, or if you prefer to keep things simple, you can download a free copy of our simple Moulds & Co Accountants Mileage Log template. Use any of these methods to record all of your mileage and information mentioned above but please be sure to keep multiple copies of it to be on the safe side. Remember, proof is important.

How much can I save?

With your evidence at hand, we can start to calculate the amount of use attributed to business purposes with any disallowance of running costs and capital allowances taken into account. This usage will be fairly based and not some arbitrary figure dictated by HMRC based on the log you provide.

How long should I keep the record?

Officially HMRC states that you must keep your mileage log (and other tax records) for at least 5 years after the 31 January submission deadline. Although HMRC won’t force you to file these records they can investigate your tax returns and will then want to see evidence of your mileage log and ensure it matches up correctly. Without this mileage log, they may disallow your deductions.

What if I’m employed?

If you are employed, have the use of a company car, and your employer pays all of your petrol for both business and personal use, then you will be subject to the car fuel benefit charge. You can avoid this by paying your employer for petrol used privately and keeping a log of these journeys.

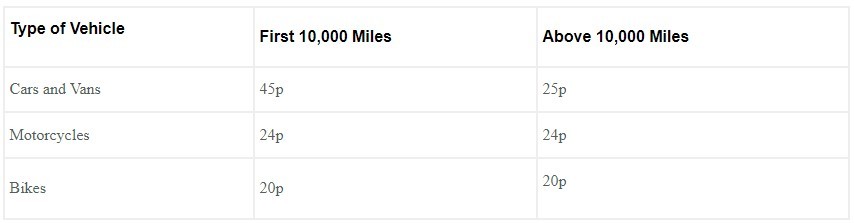

Throughout the year (you can do this in one go at the end of the year but we’d advise doing it as you go along) you should multiply the private use miles by the approved car fuel rate as shown below.

(Hybrid cars are treated as either petrol or diesel cars for this purpose and electric cars are charged at simply 4 pence per mile. More information can be found at:

Once you have found the relevant figure, simply multiply your personal use miles by the appropriate rate per mile and pay this amount to your employer.

How we can help

It can be a hassle to get into the routine of keeping track of your mileage so why not use our free template or convenient app to help you along the way?

If you have difficulty tracking down fuel mileage rates or are unsure if your journey would be classed as business or personal use, then call Moulds & Co Accountants on 01937 584188 and we’ll be happy to walk you through it.

Help this post grow!

Share this post: